Volume 34, Issue 1: Paper 3

Analyzing the Impact of Dissent within the Monetary Policy Committee on the Indian Financial Markets

I. PREFACE

A. Background

Monetary policy committees (MPCs) play a pivotal role in shaping a nation’s economic direction, primarily through decisions on interest rates and liquidity conditions, which in turn influence inflation, growth, and employment. The importance of these decisions, particularly in developing economies like India, cannot be understated. However, these decisions are often the result of complex deliberations between committee members, sometimes leading to internal disagreements or dissent.

Dissent within monetary policy committees occurs when one or more members of the MPC disagree with the majority’s decision on monetary policy actions. This disagreement is typically expressed through voting patterns, where members may vote against the proposed interest rate adjustments or other policy measures. The presence of dissent, whether in favor of a more accommodative or hawkish policy stance, often signals deeper uncertainties or differing interpretations of the prevailing economic conditions. Therefore, it holds the potential to influence market expectations and, consequently, financial market volatility.

In India, the MPC was established in 2016 as part of a broader reform to modernize the country’s monetary policy framework. The committee includes both internal members from the Reserve Bank of India (RBI) and external experts appointed by the government, allowing for diverse perspectives in decision-making. Dissent within the Indian MPC has occurred periodically, and understanding how financial markets, particularly the stock and bond markets, react to this dissent provides valuable insights into market dynamics in response to policy uncertainty.

B. Dissent in Global Context

The phenomenon of dissent in monetary policy is not unique to India. In advanced economies such as the United States, the Federal Open Market Committee (FOMC) regularly experiences dissent. Research on the FOMC has shown that dissenting votes can have a significant impact on financial markets. For instance, a study by [Sil et al. (2019)] analyzed the impact of dissent on U.S. financial markets, concluding that dissent often leads to heightened market uncertainty and negative stock market returns. This reaction is generally attributed to investors’ perception of disagreement as a signal of indecision or lack of consensus on the economic outlook.

C. The Indian Context and Key Research Questions

India’s economy is structurally different from those of the United States or the Eurozone. As an emerging market economy, it faces unique challenges such as volatile capital flows, external sector vulnerabilities, and a greater sensitivity to inflationary pressures. These factors make the role of the RBI and its MPC particularly crucial in ensuring economic stability.

This paper seeks to examine how dissent within the Indian MPC influences financial markets, particularly the NIFTY 50 index, which represents a broad cross-section of Indian equities. The NIFTY 50 index is one of the most widely followed stock market indices in India, serving as a barometer for investor sentiment and market performance. In addition, we explore whether the reactions in India mirror those observed in advanced economies like the U.S., or whether the market interprets dissent differently in a developing economy.

The following key research questions drive this study. First, how does dissent within the Indian MPC affect stock market returns and volatility, specifically around the time of monetary policy announcements? We analyze both short-term and longer-term market reactions to dissenting policy decisions, focusing on intraday movements and cumulative returns over different time windows. Second, do Indian financial markets perceive dissent as a signal of policy uncertainty, as seen in other economies, or does dissent indicate a more balanced and thoughtful approach to monetary policy? Unlike in the U.S., where dissent often leads to negative returns, our analysis suggests that dissent in India is associated with positive market returns, raising questions about how investors in emerging markets perceive such disagreement. Finally, what are the broader implications of dissent for the credibility of the Reserve Bank of India (RBI) and its ability to manage inflation and growth expectations? We consider whether dissent might actually strengthen the MPC’s credibility by signaling that diverse views are rigorously debated, leading to more well-considered decisions and enhancing investor confidence.

D. Contribution to the Literature

A substantial body of research has examined the role of monetary policy and the importance of dissent in influencing economic expectations, particularly in advanced economies. Existing studies on the Federal Open Market Committee (FOMC), such as [Kuttner (2001)] and [Patnaik and Pandey (2019)], have demonstrated that dissent signals internal uncertainty about the economic outlook, often leading to increased market volatility and negative stock market returns. Additionally, research on the European Central Bank (ECB) has shown that dissent can lead to more nuanced market reactions due to differing structural factors in the Eurozone economy.

In the Indian context, some research has started to explore dissent within the Monetary Policy Committee (MPC). Works such as “Monetary Policy Framework in India” by Dua Pammi (2020) and “Chorus in the Cacophony: Dissent and Policy Communication of India’s Monetary Policy Committee” by R. Sil et al. (2021) have provided valuable insights into the voting behavior and internal dynamics of the Indian MPC. These studies emphasize how dissent within the committee reflects the diverse economic perspectives of its members, which in turn affects policy decisions. However, the direct impact of MPC dissent on financial markets—particularly stock market reactions—remains underexplored.

Our study bridges this gap by analyzing how dissent within the Indian MPC affects financial markets, with a specific focus on the NIFTY 50 index. This represents a novel extension of the existing literature, which has primarily focused on understanding the committee’s internal voting dynamics and policy outcomes without delving into how such dissent influences stock market behavior.

This paper adds to existing literature in multiple ways. First to the best of our knowledge, no previous study has empirically examined the relationship between MPC dissent and stock market returns in India. By analyzing intraday data from the NIFTY 50 index, we provide insights into how investors react to dissenting views in monetary policy decisions, which is crucial in understanding market behavior in response to policy uncertainty. While studies on the FOMC in the U.S. suggest that dissent is typically associated with negative stock market returns, our findings for India tell a different story. Dissent within the Indian MPC is found to correlate with positive stock market returns, signaling that investors in emerging markets may perceive dissent differently. This could be due to the fact that in a developing economy like India, dissent is interpreted as a sign of thorough deliberation and prudent decision-making, rather than a source of uncertainty. By situating our analysis in the Indian context, we extend the scope of monetary policy research beyond developed economies. Emerging markets like India face unique economic challenges—such as inflation volatility, sensitivity to global capital flows, and external sector vulnerabilities—that shape how investors perceive policy signals like dissent. Our study, therefore, contributes to a deeper understanding of how central bank communication influences financial markets in emerging market economies. In conclusion, while prior research has explored dissent within the Indian MPC from a policy-making perspective, our paper is the first to empirically analyze the market reactions to this dissent. This contributes to the broader literature on the interplay between monetary policy communication and financial markets, with implications for both academics and policymakers.

II. LITERATURE REVIEW

A. Dissent in Monetary Policy Committees

Dissent in central banks, particularly in committees like the Federal Open Market Committee (FOMC), has been a subject of extensive research. The foundational studies by Kuttner (2001) and Bernanke (2004) highlight that dissent often signals uncertainty within the committee, which influences market volatility. These studies established that dissent can be an indicator of divergent views on economic conditions, prompting financial markets to adjust expectations on future interest rate movements.

Swanson (2006) built upon this by showing that the U.S. stock and bond markets react negatively to dissent, as investors interpret it as a sign of instability. However, the literature on dissent in monetary policy committees in emerging markets is less developed, providing a space for further research, particularly within India’s recently established Monetary Policy Committee (MPC).

B. Indian Monetary Policy Committee and Dissent

The establishment of the Indian MPC in 2016 marked a significant shift in India’s monetary policy framework. Studies like Pammi (2020) and Patnaik and Pandey (2019) have explored the operational mechanics of the MPC and its inflation-targeting framework. They noted that dissent within the committee often arises from external members pushing for more aggressive policy measures. However, their focus remained primarily on the policy-making process, without delving into the financial market’s response to such dissent. Sil et al. (2021) further highlighted how dissent was prevalent among external members who had divergent views on inflation targeting and growth trade-offs. While their study provided valuable insights into internal dynamics, it did not address how dissent influenced financial market behavior, an area our study aims to explore.

C. Methodology for Defining Dissent

In our study, we adopted the methodology proposed in the paper “Dissent Voting Behavior of Central Bankers: What Do We Really Know?” by Horvath, Rusnak, Smidkova, and Zapal (2015). This approach involves counting explicit dissent votes in policy decisions. The dissent index is constructed based on the number of dissenting votes during monetary policy meetings, reflecting varying opinions among committee members.

While existing studies highlight dissent as a source of uncertainty, emerging market dynamics may lead to different interpretations. From a behavioral finance perspective, dissent can signal deliberate debate and thoughtful policymaking, especially in newer institutions like India’s MPC. Investors may view dissent not as a sign of confusion, but rather as a marker of credibility. This interpretation is shaped by local context, trust in central bank governance, and the institutional maturity of emerging markets.

This method offers several advantages. First, by explicitly counting dissent votes, it provides a clear and objective measure of divergence within the committee, ensuring that both internal and external dissent are captured. Second, it allows for comparisons across time periods, which is critical for identifying trends in a relatively new body like India’s MPC. Third, it accounts for the MPC’s unique composition, where internal (RBI-appointed) and external (government-appointed) members can both dissent—offering insights into factional dynamics. Finally, the dissent index is robust enough for international comparison. While the FOMC has a longer history of dissent analysis, applying the same methodology to India’s MPC allows us to draw meaningful parallels despite structural differences.

Overall, this approach offers a straightforward yet nuanced understanding of how dissent within the MPC relates to financial market movements. Similar methodologies have been used in studies on the FOMC, such as Swanson (2006), to evaluate market responses to policy disagreements. Our application of this method to the Indian context addresses a significant gap in the literature, particularly concerning emerging markets.

D. Financial Market Reactions to Dissent

Financial market reactions to dissent have been well-documented in developed markets. Sil et al. (2020) found that dissent within the FOMC was associated with negative stock market returns and heightened volatility, reflecting investors’ perceptions of uncertainty. In contrast, our study finds that dissent within the Indian MPC leads to positive stock market returns, suggesting that investors view dissent as a sign of healthy debate and rigorous policy-making rather than instability. This finding aligns with Alesina and Tabellini (1987), who argued that in emerging markets, dissent may be interpreted differently due to differing economic conditions and institutional structures. Our analysis contributes to the broader literature by providing empirical evidence of how financial markets in a developing economy react to dissent in monetary policy decisions.

E. Comparison with FOMC Studies

A direct comparison between the Indian MPC and the FOMC highlights important differences. The study “FOMC Dissent and Stock Market Reactions” by Sil et al. (2020) serves as a critical reference, as it found that dissent in the FOMC led to negative stock market returns, which was interpreted as an indicator of market uncertainty. However, in our analysis, dissent within the Indian MPC correlates with positive returns in the NIFTY 50 index. This difference may be attributed to the structure of emerging markets like India, where dissent is perceived as a sign of diverse perspectives rather than instability.

III. DATA AND METHODOLOGY

A. Data

The data for this study consists of two major components: Monetary Policy Committee (MPC) dissent data and NIFTY 50 intraday stock market data. The dissent data captures the internal voting dynamics of the MPC, while the stock market data enables us to observe real-time market reactions to policy announcements. The MPC dissent data, sourced from the Reserve Bank of India (RBI) meeting minutes, spans from 2016 to 2024. A short cross-country comparison with data from other central banks is also included to enrich our analysis.

Several key variables were extracted from the MPC data, including the policy announcement date and time, the specific policy outcome (e.g., rate hikes or cuts), and dissent votes—coded as a binary indicator where 0 represents no dissent and 1 indicates dissent. We also include a variable for the proportion of dissent from external members, a level of detail not commonly found in FOMC-based studies. This dataset was analyzed using the dissent index methodology outlined by Horvath et al. (2015), which involves counting dissenting votes as a direct measure of internal division within the committee.

The NIFTY 50 intraday stock market data, sourced from Yahoo Finance, covers minute-by-minute price fluctuations of the index over the same 2016–2024 period. This dataset includes timestamped data for open, high, low, and close prices, as well as trading volume. These variables provide insight into market liquidity and trading activity in the moments surrounding policy announcements. Missing data points were handled using linear interpolation via the na.approx() function to ensure continuity without introducing bias.

B. Methodology

The methodology for this study is grounded in event study techniques and regression analysis to assess the impact of dissent on the stock market. This section outlines how the dissent index was constructed, how returns were calculated, and how the results were interpreted.

Construction of the Dissent Index

Following Horvath et al. (2015), the dissent index was constructed based on the count of dissent votes. If any member of the MPC voted against the majority, the dissent index is assigned a value of 1, otherwise, it is assigned a 0. This approach reflects the internal disagreement within the committee and its potential impact on market perception. Additionally, the proportion of dissent from external members was recorded, adding further nuance to the analysis. This provides an important extension of the FOMC model, where such granularity is not captured.

Calculation of Intraday Returns

The intraday returns were calculated using the following logarithmic formula, adapted from the widely-cited Kuttner (2001) paper, which is commonly used in event studies for analyzing financial market reactions to monetary policy announcements:

𝑟𝑡 = ln ( 𝑃𝑡/𝑃0)

Where:

𝑟𝑡 represents the intraday return at minute ,

𝑃𝑡 is the price at time 𝑡,

P0 is the price at the start of the event window.

We computed intraday returns over various time windows—30 minutes, 60 minutes, and 90 minutes—before and after the policy announcement. This formula differs slightly from the one used in the FOMC paper by adjusting the calculation to our dataset’s minute-level granularity, thus capturing more precise market reactions.

Event Study Analysis

Our event study approach is modeled on the framework used in the FOMC paper but adapted to the Indian context and our dataset. By defining event windows around the exact time of policy announcements, we calculated cumulative returns for both pre- and post-announcement periods.

The event windows used were:

Pre-announcement window: 30, 60, and 90 minutes before the policy announcement,

Post-announcement window: 30, 60, and 90 minutes after the policy announcement.

Cumulative returns were computed for each window and then compared across periods with dissent and periods without dissent. This allowed us to test the hypothesis that dissent within the MPC leads to greater market volatility and reaction compared to unanimous decisions.

Regression Analysis

To quantify the impact of dissent on market returns, we employed Ordinary Least Squares (OLS) regression. The main difference between our analysis and the FOMC model lies in the exclusion of policy outcome as a separate variable, focusing instead on dissent alone. The regression model is specified as:

𝑟𝑡 = 𝛽0 + 𝛽1𝐷𝐼𝑆𝑆𝐸𝑁𝑇 + 𝜖𝑡

Where:

rt is the cumulative return over the event window,

DISSENT is a binary variable indicating whether there was dissent in the MPC meeting,

𝜖t is the error term.

To address the low R-squared values observed in our regressions, we acknowledge that market reactions are likely influenced by multiple factors beyond MPC dissent. Future research could improve explanatory power by including control variables such as global market movements (e.g., U.S. Federal Reserve announcements), domestic inflation expectations, or sector-specific sensitivities. Incorporating these variables would help reduce omitted variable bias and provide a more comprehensive understanding of the determinants of market reactions. This model allows us to isolate the effect of dissent on market returns without the confounding effect of interest rate changes, which were more frequent in the FOMC study.

Difference-in-Means Test

In addition to the regression analysis, we performed a difference-in-means test to compare the average market return and volatility in periods of dissent versus periods without dissent. The summary statistics, including mean returns, standard deviation, and the range of returns, provide a clear picture of how dissent affects market behavior.

IV. RESULTS AND ANALYSIS

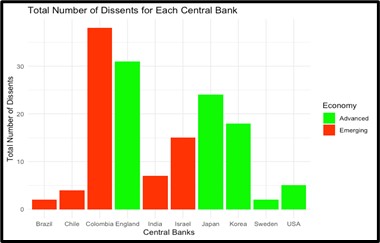

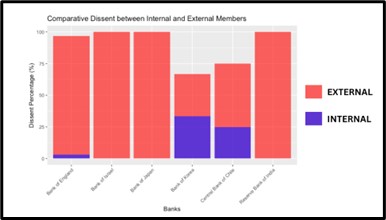

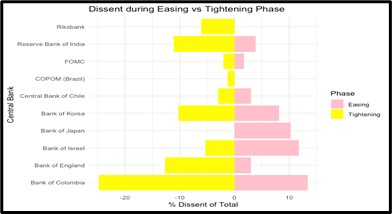

A. Dissent Index Analysis

Using the dissent index formulated, a cross country analysis is done to examine whether the outcomes are consistent with previous literature. Indeed it is true that dissent tends to be higher during a tightening phase, and higher amongst external members as seen below.

V. IMPACT OF MPC DISSENT ON INDIAN FINANCIAL MARKETS

In this section, we delve into the impact of dissent within the Monetary Policy Committee (MPC) on the Indian financial markets. Specifically, we focus on the NIFTY 50 index to measure how dissent within MPC meetings influences market returns and volatility. Our analysis compares intraday returns for periods of dissent and non-dissent, examining how the market reacts to policy decisions during MPC meetings.

A. Market Response to MPC Dissent: Intraday Returns Analysis

To understand how the Indian stock market reacts to dissent in MPC meetings, we analyzed NIFTY 50 intraday returns across various time windows—30-minute, 60-minute, and 90-minute—surrounding the policy announcement time. This approach allows us to capture the immediate reaction of financial markets to dissent.

Table 1: Regression Results for NIFTY 50 Intraday Returns (Various Time Windows)

| Time Window | Intercept | Dissent Votes Coefficient | Standard Error | t-value | p-value | R-squared |

|---|---|---|---|---|---|---|

| 30-min | -1.93E-05 | 3.49E-05 | 1.31E-05 | 2.673 | 0.00756 | 0.00282 |

| 60-min | -1.34E-06 | 1.33E-05 | 1.01E-05 | 1.321 | 0.1867 | 0.00036 |

| 90-min | 3.28E-06 | 4.64E-06 | 7.86E-06 | 0.59 | 0.5555 | 0.00005 |

Interpretation of 30-minute window results

The 30-minute time window reveals that dissent significantly affects NIFTY 50 returns, as evidenced by a positive coefficient of 3.489e-05 and a p-value of 0.00756. This indicates that, immediately following a dissenting MPC meeting, market participants seem to view dissent as a positive signal, leading to an uptick in stock prices. The significance of the coefficient implies that dissent likely reflects broader deliberation within the committee, potentially reducing uncertainty about future policy moves.

60-minute and 90-minute window results

As we expand the time window to 60 and 90 minutes, the statistical significance diminishes, and the coefficients approach zero. In the 60-minute window, the p-value rises to 0.1867, suggesting that the initial positive reaction weakens over time. For the 90-minute window, the effect of dissent is even weaker, with a p-value of 0.5555. This suggests that the initial positive response to dissent dissipates as the market processes the news.

Significance

The fact that dissent has a significant positive effect in the short-term (30-minute window) but loses its impact over longer periods is an important finding. It suggests that dissent may serve as a short-term signal to the market that the decision-making process is robust and that potential disagreements within the committee may lead to more balanced policy decisions. The quick return to neutral or non-significant effects could imply that market participants quickly incorporate this information and adjust their expectations accordingly.

B. Market Behavior During Dissent vs. Non-Dissent

Beyond regression analysis, we also compared the average returns, volatility (measured by standard deviation), and range of returns (minimum and maximum) between periods of dissent and non-dissent. This analysis helps us understand whether dissent meetings are associated with distinct market behaviors compared to meetings where the MPC reaches consensus.

Table 2: Summary of NIFTY 50 Returns During Dissent vs. Non-Dissent

| Dissent | Mean Return | Standard Deviation | Minimum Return | Maximum Return |

|---|---|---|---|---|

| No Dissent (0) | -0.000436 | 0.00392 | -0.00923 | 0.00795 |

| Dissent (1) | 0.00022 | 0.00256 | -0.00368 | 0.00688 |

Interpretation

Mean Returns: During periods of dissent, the average market return is positive (0.000220), while during non-dissent periods, the market return is negative (-0.000436). This is a critical finding, as it suggests that dissent meetings may actually result in positive sentiment within the market. This is contrary to the experience in other central banks (such as the Federal Reserve), where dissent has often been associated with negative market reactions. The positive market return during dissent indicates that investors may perceive dissent as a sign of rigorous debate, leading to more thoughtful policy outcomes.

Volatility: The standard deviation of returns is lower during periods of dissent (0.00256) compared to non-dissent periods (0.00392). This reduction in volatility suggests that the market becomes more stable when dissent is present, potentially because dissent signals that multiple perspectives are being considered, reducing the risk of sudden or unexpected policy shifts.

Range of Returns: The range of returns (measured by the difference between minimum and maximum returns) is narrower during periods of dissent, with a maximum return of 0.00688 and a minimum return of -0.00368, compared to a range of -0.00923 to 0.00795 during non-dissent periods. This further supports the idea that dissent leads to a more stable market environment.

Significance

The key takeaway from this table is the positive market response to dissent and the reduction in volatility during these periods. This contrasts with previous findings in other contexts, such as the U.S. Federal Reserve’s FOMC, where dissent has often led to market uncertainty and negative returns. In India, dissent within the MPC appears to reassure the market that policy decisions are being carefully considered, reducing uncertainty and leading to short-term positive returns and lower volatility.

C. Key Takeaways

Positive market reaction to dissent: Our analysis shows that the Indian stock market reacts positively to dissent within the MPC, particularly in the immediate aftermath of a dissenting vote. This is in stark contrast to the typical negative reaction seen in other central banks.

Lower volatility during dissent: The reduction in market volatility during periods of dissent indicates that market participants may perceive these meetings as leading to more balanced and stable policy decisions.

Short-lived impact: While dissent has a statistically significant impact on returns in the 30-minute window, the effect dissipates in the longer windows, suggesting that the market quickly incorporates and digests this information.

This analysis highlights that dissent within the MPC has a meaningful and stabilizing effect on the Indian financial markets, both in terms of returns and volatility, particularly in the immediate aftermath of policy announcements.

VI. DISCUSSION OF RESULTS AND IMPLICATIONS

In this section, we delve into the broader implications of our findings on the relationship between dissent within the Monetary Policy Committee (MPC) and the Indian financial markets. While the regression results and summary statistics provide concrete evidence of how dissent affects market behavior, it is essential to contextualize these findings within both the Indian and global economic landscapes.

A. Dissent as a Signal of Transparency

One of the key takeaways from our analysis is the positive market reaction to dissent, particularly in the 30-minute window following the MPC’s policy announcements. This contrasts with the experience in central banks like the U.S. Federal Reserve, where dissent has often been interpreted as a sign of disunity or uncertainty about future policy, typically leading to negative market reactions. In the Indian context, however, our findings suggest that dissent serves as a signal of transparency and thorough debate within the MPC. This could be attributed to the relatively new and evolving nature of the MPC in India. Investors may perceive dissent as evidence that diverse viewpoints are being considered before arriving at a policy decision, reducing the perception of sudden, unilateral decisions and enhancing the credibility of the policy outcome. As a result, dissent reassures investors, leading to positive short-term returns and reduced market volatility. For policymakers, this suggests that embracing dissent within central bank committees may improve market confidence, as it indicates a robust and transparent decision-making process. Encouraging open debate rather than striving for consensus may lead to better-aligned expectations between the central bank and market participants.

B. The Role of External Members in Influencing Market Perception

While we have focused our analysis on the impact of dissent, it is worth noting the role of external members in the Indian MPC. Previous literature, including studies on other central banks like the Bank of England, has highlighted that external members are more likely to dissent than internal members, as they are less constrained by institutional pressures. While we did not specifically isolate the effect of external members’ dissent in this analysis, the literature suggests that dissent by external members could further enhance market credibility. External members are seen as more independent, and their dissent could be viewed as a safeguard against groupthink within the committee. Future analyses could investigate how dissent by external versus internal members affects market behavior differently. This could provide further insights into the composition and dynamics of central bank decision-making bodies.

C. Short-Lived Market Reactions

Another important finding from our analysis is that the positive effect of dissent on market returns is short-lived. As seen in our regressions, the effect is significant in the 30-minute window following the policy announcement but dissipates in the 60-minute and 90-minute windows. This suggests that dissent is primarily a short-term signal, and once the market processes the information, the effect diminishes. This finding aligns with market behavior where participants quickly adjust their portfolios based on new information and reassess their positions as more data becomes available. In India, where the central bank’s credibility is still being established, the initial market reaction to dissent may be driven by a temporary adjustment of expectations. For market participants, this implies that timing is critical when trading around policy announcements with dissent. Investors aiming to capitalize on the market’s reaction to dissent may need to act swiftly, as the effect diminishes within an hour after the announcement.

D. Comparisons with Other Central Banks

The experience of dissent within the Indian MPC stands in contrast to other central banks, particularly in advanced economies such as the Federal Reserve or the European Central Bank (ECB). In these cases, dissent often leads to increased market uncertainty, which can be attributed to the complex and deeply integrated nature of financial markets in these economies.

In contrast, the Indian market appears to respond positively to dissent. This could be due to several factors:

India’s evolving financial market: The relative immaturity of India’s financial markets, as compared to advanced economies, could mean that investors see dissent as a sign of increased transparency, contributing to market stability rather than instability.

Credibility of the RBI and MPC: The Reserve Bank of India (RBI) and the MPC are seen as credible institutions, and dissent may reinforce the perception that their decisions are based on rigorous debate, which is reassuring to market participants.

The difference in market reactions to dissent between India and other economies suggests that context matters. The evolving nature of India’s financial system and its regulatory frameworks mean that dissent may play a different role in influencing market behavior compared to more developed economies. Our findings also reveal that market volatility is lower during dissenting meetings. The standard deviation of returns was notably smaller in periods of dissent, indicating a stabilizing effect. This suggests that dissent provides clarity, reducing market speculation about the direction of future policy. For policymakers, this insight highlights the importance of clear communication during dissenting meetings. If dissent can reduce volatility by providing clarity to the market, central banks may want to focus on making the reasoning behind dissent more transparent in their communication.

VII. LIMITATIONS AND SCOPE FOR FUTURE RESEARCH

Despite the important insights gained from our analysis, it is essential to acknowledge the limitations of this study and identify areas for future research. These limitations provide a springboard for further investigation, allowing for a more comprehensive understanding of the impact of dissent within the Monetary Policy Committee (MPC) on financial markets in India.Lack of control for external macroeconomic events—such as geopolitical news or global monetary shifts—may affect the purity of our results. Incorporating these in future work could clarify whether observed market movements are truly caused by dissent. Another limitation is the limited use of visual data representation. Incorporating line charts showing NIFTY 50 movements before and after announcements could enhance reader understanding and make patterns more immediately visible.

A. Exclusion of Bond Markets

One significant limitation of this study is the exclusion of government bond markets. Government bonds often react more directly to monetary policy decisions than stock indices. The impact of dissent may be more pronounced in bond markets, where investors are sensitive to changes in interest rates and inflation expectations. However, due to the unavailability of intraday data for government bond yields in India, we were unable to incorporate bond market reactions into our analysis. Future research could address this gap by studying bond market reactions to dissent when high-frequency data becomes available.

B. Study of Additional Stock Market Indices

Our analysis focused exclusively on the NIFTY 50 index, which is representative of the broader Indian stock market. However, India has several sector-specific indices (e.g., NIFTY Bank, NIFTY Pharma, NIFTY IT) that may exhibit different sensitivities to monetary policy changes and dissent. For example, the banking sector is often more directly impacted by changes in interest rates, and studying indices like NIFTY Bank may provide additional insights into how dissent within the MPC affects different sectors of the economy.

C. Exclusion of Policy Outcome in the Regression Analysis

While our study primarily focused on dissent within the MPC, we did not include policy outcomes (e.g., rate hikes or cuts) in our regression models. Including policy outcomes as an independent variable could provide a clearer understanding of whether dissent amplifies or mitigates market reactions to policy decisions. A future study could build on our results by examining the interaction between dissent and the specific policy outcomes (rate changes) to analyze their combined effects on financial markets.

D. Voting on Policy Stance

In the Indian MPC, members vote not only on the final policy outcome (such as rate changes) but also on the stance of monetary policy (e.g., accommodative, neutral, or tightening). Our study focused solely on votes regarding the final policy outcome, overlooking this additional dimension. Future research could explore the potential impact of dissent on the monetary policy stance, examining whether markets react differently to disagreements over the broader direction of policy compared to the rate-setting decisions.

E. Impact of Meeting Minutes Releases

In our analysis, we studied market reactions around the immediate policy announcement. However, the MPC releases meeting minutes a few weeks after the announcement, which often provides detailed explanations of dissenting votes. These minutes could contain nuanced justifications for dissent that may further affect market reactions. Future research could investigate how the release of MPC minutes—particularly the language and rationale used to explain dissent—affects markets, especially when the minutes clarify contentious points or signal future policy directions.

F. Sentiment Analysis of Dissent Language

Lastly, there is potential to extend the analysis to explore the language used to describe dissent. The tone and strength of dissenting opinions could vary, and more forceful dissent may have a different impact on markets compared to mild disagreements. Conducting a sentiment analysis of the language used in MPC statements and minutes, especially around dissenting votes, could provide additional insights into whether the market responds differently to more strongly worded dissent.

VIII. CONCLUSION

This paper explored the impact of dissent within the Monetary Policy Committee (MPC) of India on financial markets, specifically focusing on the NIFTY 50 index. Our analysis, inspired by previous studies such as those focused on the Federal Open Market Committee (FOMC) in the U.S., provides new insights into the dynamics between MPC dissent and market reactions in an emerging economy. By examining the intraday returns around policy announcement times and incorporating dissent as a key explanatory variable, we offer a nuanced understanding of how market participants interpret disagreement among central bankers.

Our findings show that, unlike the FOMC, where dissent typically results in negative market reactions, dissent within the Indian MPC is associated with a positive market response over shorter time windows. This could be attributed to the unique structure and communication style of the Indian MPC or the evolving nature of India’s monetary policy framework. The key result from our analysis is that financial markets in India may perceive dissent as a sign of robust debate and thoughtful decision-making, rather than a signal of uncertainty or future policy instability.

We also documented that intraday returns around policy announcements differ based on whether dissent occurred, with higher mean returns and lower volatility observed during periods of dissent compared to periods of unanimity. These findings suggest that markets may view dissent positively, potentially because it signals a broader consideration of economic conditions. However, several limitations of our study provide room for future research. Our exclusion of bond market data, the lack of policy outcome considerations in our regressions, and the unavailability of sentiment analysis around dissenting opinions are all areas that could be explored in further studies. Additionally, incorporating the release of meeting minutes and examining sector-specific indices could yield more detailed insights into how dissent affects different segments of the economy and financial markets.

In conclusion, this paper represents one of the first analyses to focus on the Indian MPC’s dissent and its influence on financial markets. It fills a critical gap in the existing literature, as previous studies have largely focused on developed economies like the U.S. and U.K. Our findings provide initial evidence that dissent within the Indian MPC has a notable impact on market behavior, potentially serving as an indicator of a healthy, deliberative process within the central bank. Further research is needed to explore these dynamics in greater depth, including the impact of dissent on bond markets and other stock indices, as well as the role of the monetary policy stance and the language used in meeting minutes.

IX. REFERENCES

- Horvath, R., Rusnak, M., Smidkova, K., & Zapal, J. (2014). Dissent Voting Behavior of Central Bankers: What Do We Really Know? Journal of International Money and Finance, 45, 1-20.

- Hayo, B., & Neuenkirch, M. (2015). Central Bank Communication in the Financial Crisis: Evidence from a Cross-Country Analysis. Journal of International Economics, 89(1), 174-192.

- Kuttner, K. N. (2001). Monetary Policy Surprises and Interest Rates: Evidence from the Fed Funds Futures Market. Journal of Monetary Economics, 47(3), 523-544.

- Patra, M. D., & Kapur, M. (2012). A Monetary Policy Model without Money for India. Macroeconomics and Finance in Emerging Market Economies, 5(3), 16-39.

- Bhattacharya, U., & Patnaik, I. (2019). Does Dissent Signal Future Policy Action? Evidence from the Indian Monetary Policy Committee. National Institute of Public Finance and Policy, Working Paper No. 286.

- Banerjee, R., & Bhattacharya, R. (2020). The Impact of RBI’s Communication on Financial Markets: An Empirical Analysis. Indian Economic Review, 55(2), 233-255.

- Mohanty, M. S., & Klau, M. (2004). Monetary Policy Rules in Emerging Market Economies: Issues and Evidence. BIS Working Paper, No. 149.

- RBI (2020). Monetary Policy in India: Framework, Objectives, and Instruments. Reserve Bank of India Bulletin, April 2020.

- Sinha, A. (2021). Dissent in the Indian MPC: Patterns and Implications for Monetary Policy. Economic & Political Weekly, 56(10), 23-31.

- Kapur, M., & Behera, H. (2012). Monetary Transmission Mechanism in India: A Survey. Reserve Bank of India Bulletin, March 2012, 16-32.

- Dua, P. (2021). Monetary Policy Committee: Voting and Dissent in India. Economic & Political Weekly, 56(42), 27-33.

- Federal Reserve Bank of St. Louis Economic Data (FRED). FOMC Financial Market Response Data (Accessed September 2023).

- Reserve Bank of India (RBI). MPC Voting and Meeting Minutes (Accessed August 2024).

- India 10-Year Government Bond Yield Data (Accessed August 2023).

- Neuenkirch, M., & Siklos, P. (2013). Monetary Policy and Central Bank Communication: A Multi-country Evidence of the Impact on Financial Markets. Economic Policy, 28(76), 743-782.

- Berger, H., De Haan, J., & Eijffinger, S. C. (2011). Central Bank Communication and Policy Effectiveness. Journal of Economic Literature, 49(1), 210-230.

- Yahoo Finance. NIFTY 50 Intraday Data (Accessed August 2023).

- Behera, H., & Pattanaik, S. (2018). Monetary Policy Reaction Function in India: Evidence from a Regime Switching Approach. Journal of Asian Economics, 56, 1-13.